MEDICARE

Everybody knows there’s something special about turning 65. For most of us, it’s when we qualify for Medicare, the federal health insurance program for seniors. But for many Montanans, Medicare is only part of the picture of covering your healthcare costs. Montanans can also purchase a Medicare Advantage or Medicare Supplement plan to cover expenses that Medicare doesn’t—like deductibles and your share of a doctor or hospital bill.

Add it all up and there’s a lot to consider as you approach 65.

Medicare is divided up into two parts—Part A (hospitalization) and Part B (provider services). Each part covers different services and carries different out-of-pocket costs. You can buy insurance that fills in the gaps. Confused yet? See helpful resources below.

CSI regulates all Medicare Supplement insurance sold in Montana. If you have questions, contact CSI Consumer Services at 800.332.6148 or 406.444.2040

The Montana Department of Health and Human Services (DPHHS) through State Health Insurance Assistance Program (SHIP) offers trained, in-person assistance at locations throughout the state to answer questions.

RESOURCES

When do I need to enroll in Medicare?

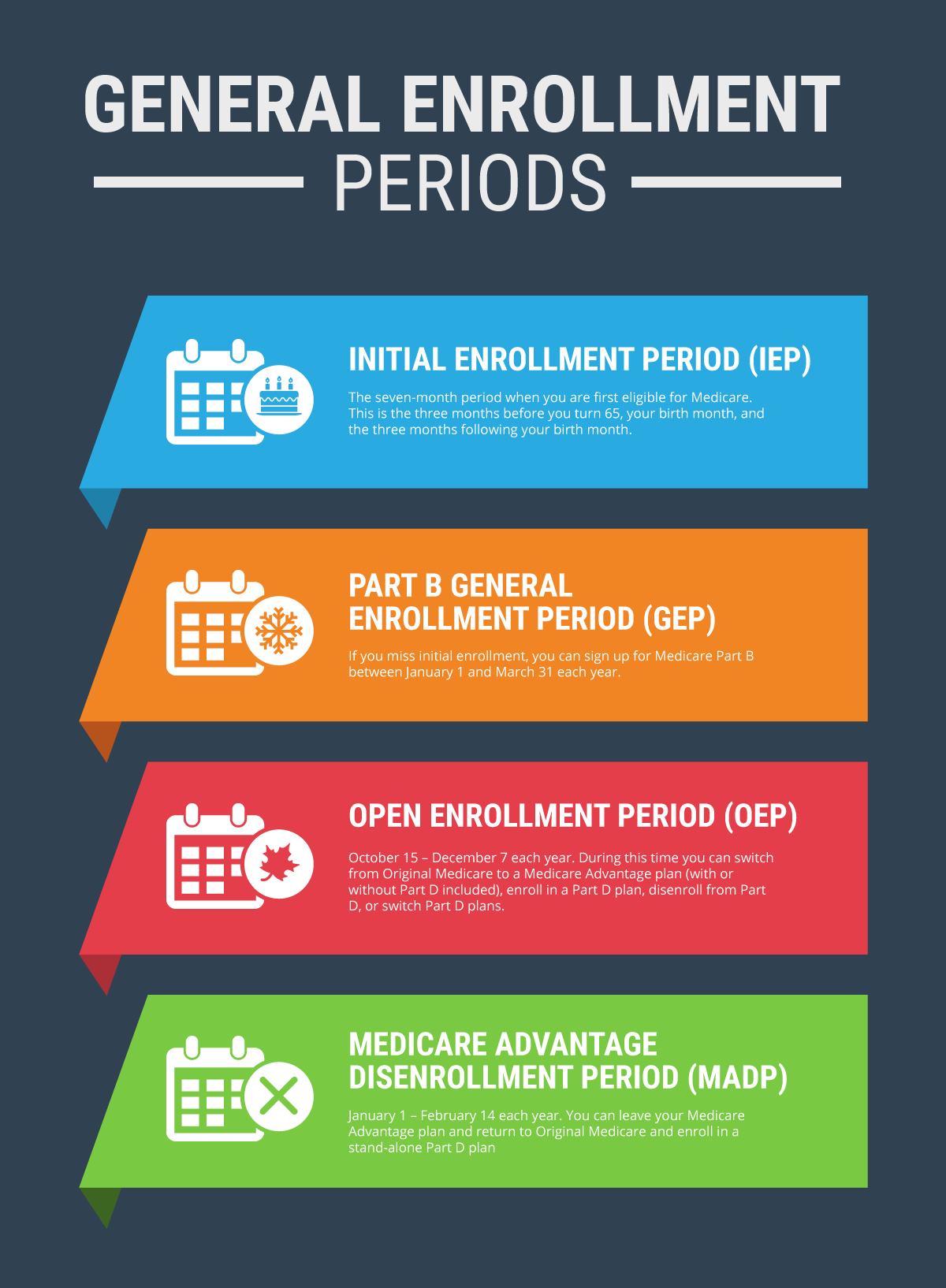

Most people will be automatically enrolled in Medicare Part A; if you are not working, you should enroll in Part B three months before your 65th birthday, the month of your birthday or up to three months after your birthday.

I’m still working after age 65; must I enroll in Medicare Part B?

Check with your benefits administrator at work to determine if your employer health plan requires you to enroll in Part B; you may be able to delay enrolling in Part B without penalty until you retire.

I have Medicare Supplement Insurance. Can I change plans or companies?

You can, but the new plan or company may not write a policy for you if you have any serious health conditions.

When does my open enrollment period for Medicare Part A and Part B start?

Open enrollment lasts for 6 months beginning on the first day of the month when the individual is 65 years of age and enrolled in Medicare Part B.

I’m under 65 but have Medicare because I am disabled. What are my options for supplemental insurance?

Some individuals may qualify for coverage with a Medicare Advantage Plan. The companies that offer Medicare supplement policies to people over age 65 also offer coverage to those under age 65 in certain instances. For a list of companies that offer this type of insurance, see our Medicare Supplement Rate Guide.

Do I have a local resource for help with Medicare issues?

The State of Montana operates a free help program to assist Medicare beneficiaries and their families understand and enroll in Medicare programs. The State Health Insurance Assistance Program (SHIP), offers trained, in-person assistance throughout Montana. For more information, call 1-800-551-3191 or visit the SHIP website.

What happens if my insurance company no longer operates in the state of Montana?

You would have the right to purchase another Medicare Supplement Plan A, B, C*, D*, F*, G*, K, or L sold in Montana by another insurance company. You must apply for the new Medicare Supplement policy no later than 63 calendar days from the date your coverage ends.

*Note: Plans C and F will no longer be available to people who are new to Medicare on or after January 1, 2020. However, if you were eligible for Medicare before January 1, 2020, but are not yet enrolled, you may be able to buy Plan C or Plan F. People eligible for Medicare on or after January 1, 2020, can buy Plans D and G instead of Plans C and F.

CSI MEDICARE SUPPLEMENT

PRICE COMPARISON

Find the plan and company that are right for you. The annual premium rates can be found HERE.

Premium changes occur throughout the year and are applied to your policy generally at your renewal date. For the most specific and accurate information, please contact the individual insurance companies.